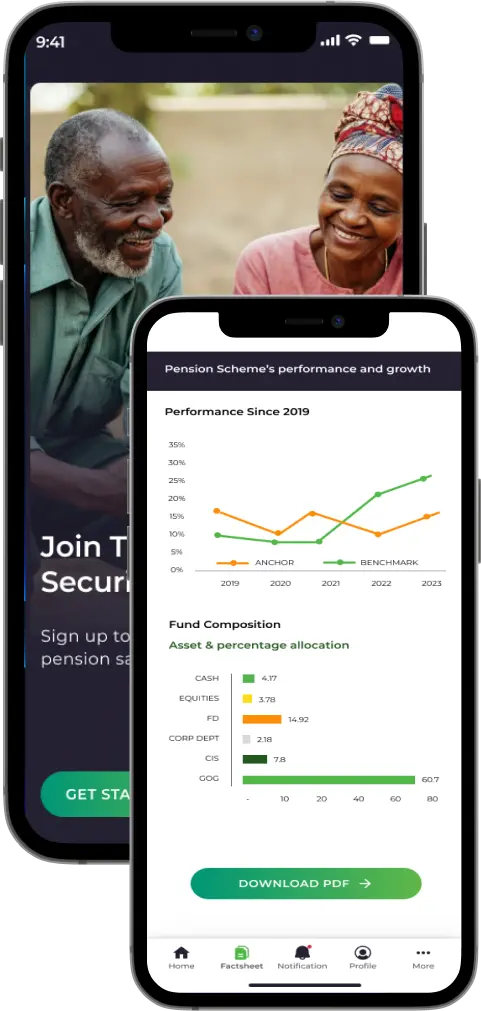

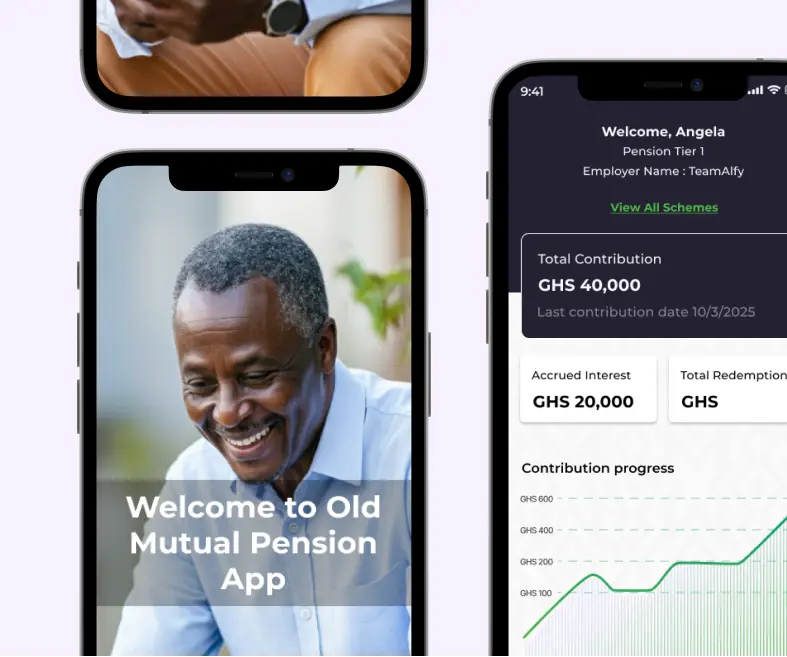

CASE STUDY

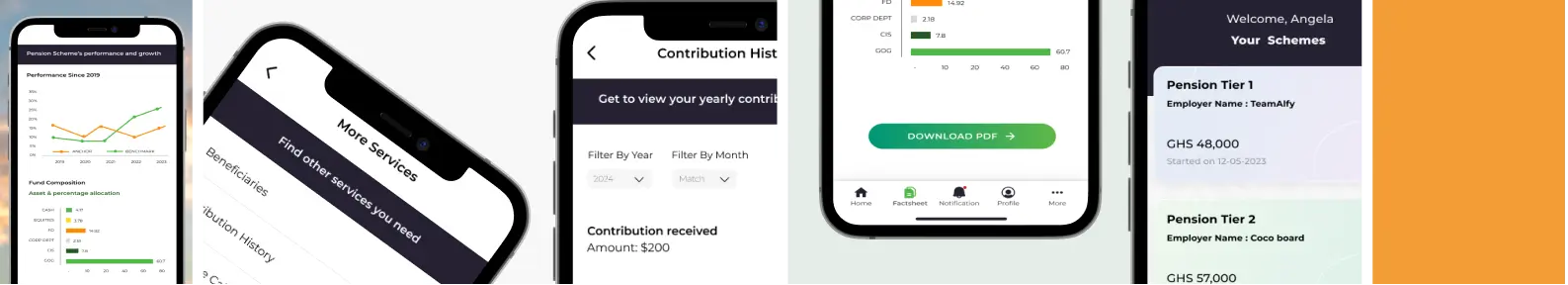

Digitizing Pension Access with Old Mutual

OVERVIEW

Old Mutual aimed to modernize how pensioners interact with their retirement accounts by introducing a user-friendly mobile app that streamlines contribution tracking, statement access, and beneficiary management