Case Study

Old Mutual’s USSD & WhatsApp Transformation

Overview

Explore how TeamAlfy’s innovative digital transformation empowered Old Mutual to deliver a mobile-first, omni-channel experience and achieve higher policy uptake.

Old Mutual’s USSD & WhatsApp Transformation

Explore how TeamAlfy’s innovative digital transformation empowered Old Mutual to deliver a mobile-first, omni-channel experience and achieve higher policy uptake.

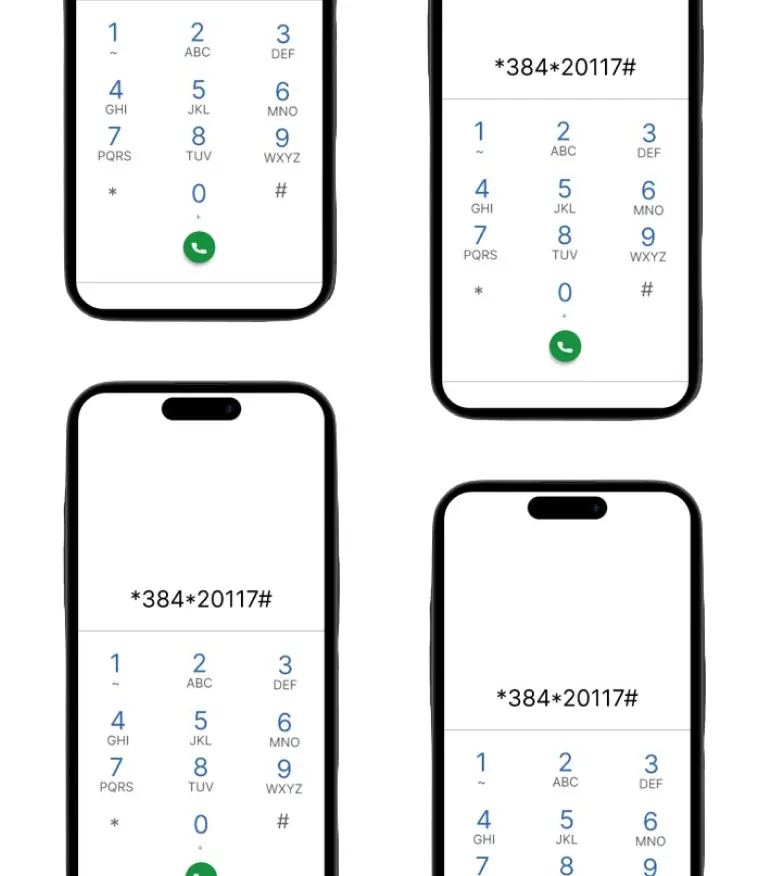

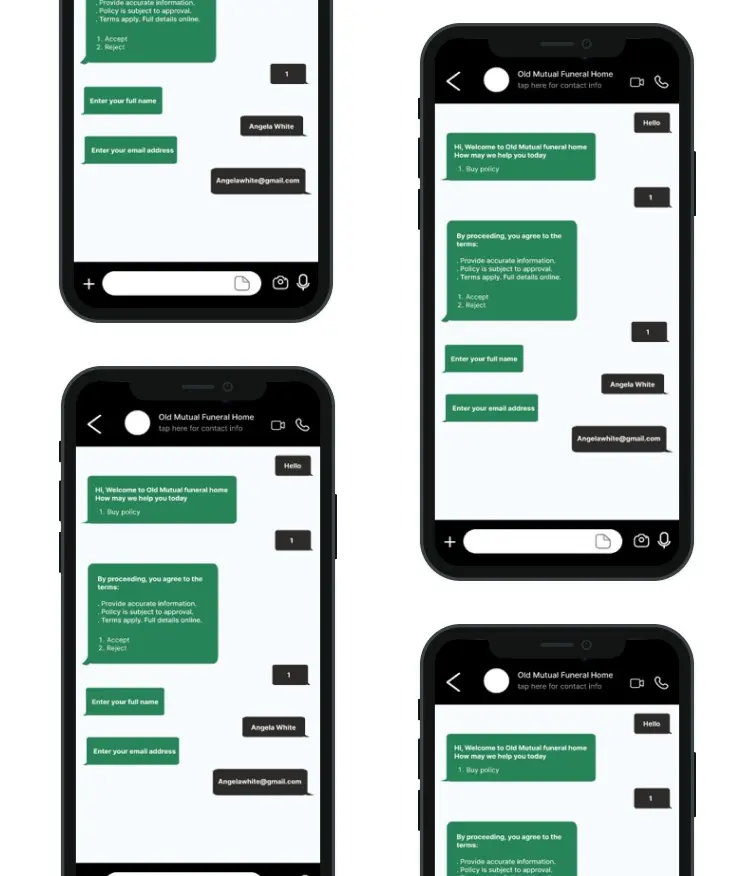

A fully integrated USSD and WhatsApp Chat ecosystem, tailored to Old Mutual's backend APIs and mobile payment gateways

Phased implementation across six months, finalized in early 2025, allowing extensive user acceptance testing and staff training.

Primarily designed for Old Mutual’s customer base in Ghana, leveraging highly adopted mobile channels and WhatsApp’s wide user penetration

A collaborative effort between TeamAlfy (led by Engagement Director Alfy Opare Saforo) and Old Mutual’s team—key roles include Project Manager Esther Ofori and QA Lead Anne-Marie Dumenu.

95% Enhanced Accessibility

30% Increase in Policy Applications

40% Faster Application Time

40% Boost in Lead Conversion

TeamAlfy’s solutions were a turning point. Their USSD and WhatsApp implementations drastically simplified how our clients engage with us.

From QA to final launch, TeamAlfy’s approach was seamless. The chatbot’s conversational flows have elevated our customer satisfaction rates

Request a Demo and discover how TeamAlfy’s mobile-first, AI-driven solutions can revolutionize your customer engagement and boost your operational efficiency.

Request a Demo NowBy focusing on digital transformation, mobile-first approaches, and AI-driven customer engagement, this Old Mutual case study illustrates how strategic USSD and WhatsApp chatbot solutions can increase policy sales, improve customer satisfaction, and reduce operational bottlenecks. Backed by robust integrations and real-world results, TeamAlfy stands ready to deliver innovative, scalable solutions tailored to your organization.

Ready to see results like Old Mutual? Contact TeamAlfy and let’s revolutionize your customer experience together.